Des infooooos & conseiiiiiils

par l’équipe de DiYa !

Comment planter des tomates en pot de manière pratique et efficace ?

La culture de tomates en pot est une excellente option pour les jardiniers disposant d’un espace limité ou pour ceux qui souhaitent simplement profiter de cette délicieuse légume sans avoir à labourer un grand potager. Dans cet article, nous allons…

Comment obtenir une consultation de voyance gratuite et immédiate pour des questions relatives à votre couple ?

La vie de couple est parsemée d’embûches et de questionnements. Pour vous aider à y voir plus clair, une consultation de voyance gratuite et immédiate peut être la solution idéale. Dans cet article, nous vous expliquons comment obtenir une séance…

Où trouver des caisses en carton solides pour le stockage ?

Le choix de caisses en carton solides est essentiel pour assurer un stockage sécurisé et durable. Que ce soit pour un déménagement, une rénovation ou simplement pour organiser votre espace de vie, il est crucial de trouver des caisses adaptées…

Structure gonflable publicitaire : un outil promotionnel impactant pour votre entreprise

Les entreprises sont constamment à la recherche de moyens efficaces pour attirer l’attention des clients et se démarquer de la concurrence. Parmi les nombreuses options disponibles, la structure gonflable publicitaire s’impose comme un choix judicieux, offrant une visibilité inégalée et…

Où trouver des boucles d’oreilles pendantes en argent pour ajouter une touche d’élégance à votre style ?

Les boucles d’oreilles pendantes en argent sont un élément indispensable pour rehausser votre look et ajouter une touche d’élégance à votre style. Que vous soyez à la recherche d’une paire pour une occasion spéciale ou pour le quotidien, il existe…

Filorga avis dermatologue : Les bienfaits des produits Filorga pour votre peau

Les produits Filorga sont de plus en plus reconnus pour leur efficacité et leur qualité. Les avis des dermatologues sur ces produits confirment leur réputation grandissante dans le domaine des soins de la peau. Dans cet article, nous allons vous…

Où trouver un hôtel pas cher à Saint Martin de Ré ?

Vous prévoyez de partir en vacances sur l’île de Ré et vous êtes à la…

Mise en place de la BDese : Les démarches pour déclarer et rémunérer ses salariés

Étude Kinésithérapeute: Les clés pour exceller dans vos études de kinésithérapie

Marque croquette chien : Analyse des meilleures offres sur le marché

Assurer une moto qui ne roule pas : Conseils pour une protection adaptée

Location de dameuse : Faciliter vos travaux de terrassement avec le bon matériel

Quels produits sont disponibles à la pharmacie rue du Four à Paris ?

Les défis de la médecine moderne : le rôle du double cursus

Planification successorale et gestion de patrimoine : protéger votre héritage

Élever des chèvres dans son jardin : guide pour les débutants

Quelles sont les dernières inventions qui vont changer notre quotidien?

Comment optimiser son assurance habitation en tant que propriétaire non

Quand vous êtes propriétaire-bailleur, il peut être intéressant d’assurer le logement loué. Pour ce faire,…

Quelle routine de soins de la peau est recommandée pour les hommes ?

Autrefois, les femmes accordaient une réelle attention à leurs soins et elles étaient les seules….

Comment et quand changer le filtre à particules de votre voiture ?

Êtes-vous l’un de ces propriétaires de voitures qui ignorent quand et comment changer le filtre…

Comment reconnaître et que faire en présence de coccinelles venimeuses ?

Les coccinelles sont souvent perçues comme des insectes mignons et inoffensifs qui égayent nos jardins…

Quels sont les facteurs influençant le prix de création d’un site internet ?

Découvrez comment estimer le prix de la création d’un site web, grâce aux principaux éléments…

Comment utiliser les signaux de trading pour prendre des décisions éclairées dans les transactions en cryptomonnaies ?

Dans le quotidien dans lequel on se trouve, inutile de dire que les opportunités pour…

Quelles sont les meilleures plantes couvre-sol pour le jardin ?

Les plantes couvre-sol sont des vivaces arbustives rampantes qui ajoutent une touche décorative au pied…

Douleur sternum grossesse : causes et gestion

La grossesse est une période merveilleuse, mais elle peut également s’accompagner de diverses douleurs et…

Comment procéder à la reprise de cartouches d’encre pleines et quels sont les avantages en termes d’écologie et d’économie ?

Vous avez une imprimante chez vous mais vous devez changer de modèle car celle-ci ne…

Idées cadeaux pour un garçon de 2 ans

Votre petit garçon fête ses 2 ans dans quelques semaines, et vous êtes en pleine…

Enceinte chantier : écoutez de la musique en toute sécurité sur votre lieu de travail

Dans le secteur du BTP, la musique joue souvent un rôle capital pour entretenir la…

Bouchon muqueux : tout savoir sur ce phénomène de grossesse en images

Dans le cadre de votre grossesse, vous allez pouvoir vivre toutes sortes de phénomènes qui…

Volet roulant pour meuble de cuisine pour gagner de la place

Un volet roulant est un élément utile dans l’agencement d’un meuble de cuisine. Son installation…

Trouvez la robe de soirée grande taille parfaite

Trouver la robe de soirée idéale pour une occasion spéciale peut s’avérer décourageant, surtout si…

Une couette pour toutes les saisons – Couette 4 saisons

Vous en avez assez de changer la literie chaque fois que le climat se réchauffe…

Où planter le basilic : soleil ou ombre ? Conseils pratiques

Le basilic est une plante originaire de l’Inde et est utilisé depuis des siècles pour…

Engourdissement du bras gauche dû au stress

De nos jours, il existe de plus en plus de personnes qui ressentent des moments…

Comment repiquer les navets : astuces et étapes à suivre

Faire pousser ses légumes sur un coin de terre s’accompagne toujours de nombreux bénéfices. De…

Comment acheter en friperie entre particuliers ?

Avec l’inflation qui touche de plein fouet la France et même le reste du monde,…

Prix pose vernis semi-permanent : Combien coûte une pose de vernis semi-permanent en salon de beauté ?

Le vernis semi-permanent est l’un des produits les plus populaires dans le monde de la…

agence acquisition digitale : Trouvez le partenaire idéal pour booster votre visibilité en ligne

De nos jours, il est devenu indispensable pour toute entreprise qui se prend au sérieux…

Montre de golf Garmin S40 : Les fonctionnalités indispensables pour améliorer votre jeu

Quel swing ! Aujourd’hui on parle golf et amélioration de jeu grâce à la montre…

Quelle est la meilleure montre connectée pour les femmes alliant style et fonctionnalités ?

Vous avez envie de vous faire plaisir ou d’offrir un cadeau à un de vos…

Comment trouver le diamètre d’un cercle à partir de son aire ou de sa circonférence

Enseignées dès l’école primaire lorsqu’il s’agit tout simplement d’apprendre à compter et à réaliser des…

Où peut-on trouver les meilleurs campings en bord de mer à Argeles sur Mer ?

Après une année intense au niveau du travail, vous souhaitez par dessus tout vous ressourcer…

Comment sélectionner un copieur professionnel adapté à votre entreprise?

Dans les entreprises, certains appareils sont incontournables. Vous devez donc choisir une photocopieuse par exemple,…

Chambre sous comble très bas: Comment l’aménager

Il arrive que le nombre de pièces dans une maison ne suffise pas et qu’on…

Comment calculer facilement votre taux d’endettement : définition, formule et astuces pratiques

Estimer son taux d’endettement est important pour connaître sa capacité d’emprunt, notamment pour un futur…

Comment connaître votre signe astrologique chinois et quels sont ses caractéristiques ?

L’astrologie chinoise comprend 12 signes. Pour savoir quel signe astrologique chinois et quelles caractéristiques vous…

Où trouver de la cire végétale pour fabriquer des bougies en gros ?

La cire est un composant important qui détermine la réussite de votre fabrication de bougies….

Caméra d’inspection de canalisation : comment choisir le bon modèle ?

Fort heureusement, ce n’est pas tous les jours que vous allez avoir l’occasion de choisir…

Comment trouver une femme de ménage expérimentée à Genève ?

La recherche d’une femme de ménage est une étape importante qu’il ne faut pas prendre…

Assurance pour bateau à moteur : Des solutions pour protéger votre bateau à moteur

Vous venez d’acquérir un bateau à moteur ? Félicitations ! Vous pouvez désormais vous demander…

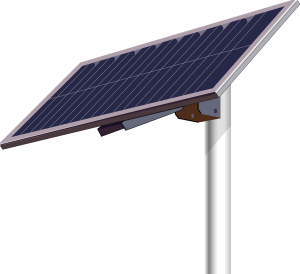

Comment choisir le support idéal pour des panneaux solaires installés au sol ?

L’énergie solaire est une source d’énergie renouvelable en pleine expansion et les panneaux solaires sont…

Séjour bien-être dernière minute : Les meilleures offres de séjour bien-être à la dernière minute et les critères à prendre en compte pour choisir le séjour idéal

Les séjours bien-être sont une excellente façon de prendre soin de soi et de se…

Quel logiciel de création de site choisir pour débuter ?

Pour créer un site web, vous pouvez commencer à apprendre à écrire du code dans…

Quel matelas 1 personne choisir pour un sommeil réparateur ?

Si vous êtes à la recherche d’un matelas une personne de qualité, vous devrez prêter…

Comment fixer des chevrons sur un mur en parpaing ?

Les chevrons sont particulièrement utiles dans les projets de construction où une résistance accrue est…

Comment trouver un collier pour signe astrologique Gémeaux pour un cadeau original ?

Trouver le cadeau idéal peut être une tâche ardue. Qu’il s’agisse d’un anniversaire ou d’une…

Décoration anniversaire 18 ans: Célébrez votre majorité en style

Vous allez bientôt atteindre l’âge de la majorité, et vous comptez fêter cette étape importante…